A Post Brick-and-Mortar Reality

Right now we have a lot more questions than answers, but new discoveries surrounding COVID 19 change by the hour. The pandemic has shaped our everyday lives – in sectors such as healthcare, education and consumerism & commerce. Our homes have become our playgrounds, our offices, our places of solace, and evidently, our shopping headquarters.

Hermes retail store

The “New Normal”

When we get to the other side of the pandemic, we will start to see a hybrid structure of people working from home and in the office. Same goes for shopping habits – many will choose to shop online or local, while fewer others brave the return into physical locations.

Adapting to new standards doesn’t have to feel like reinventing the wheel, but when it comes to commerce, new rules do apply to a post-pandemic norm.

Public shopping boulevards and malls will operate at less than half capacity, welcoming fewer people than pre-lockdown days. Particularly in high street fashion cities like Milan, Paris and Rome, we are seeing a collapse in the usual appeal of brick-and-mortar shops. Vogue business reports that there is a correlation between tourism and retail shopping – and the two are greatly impacted by each other.

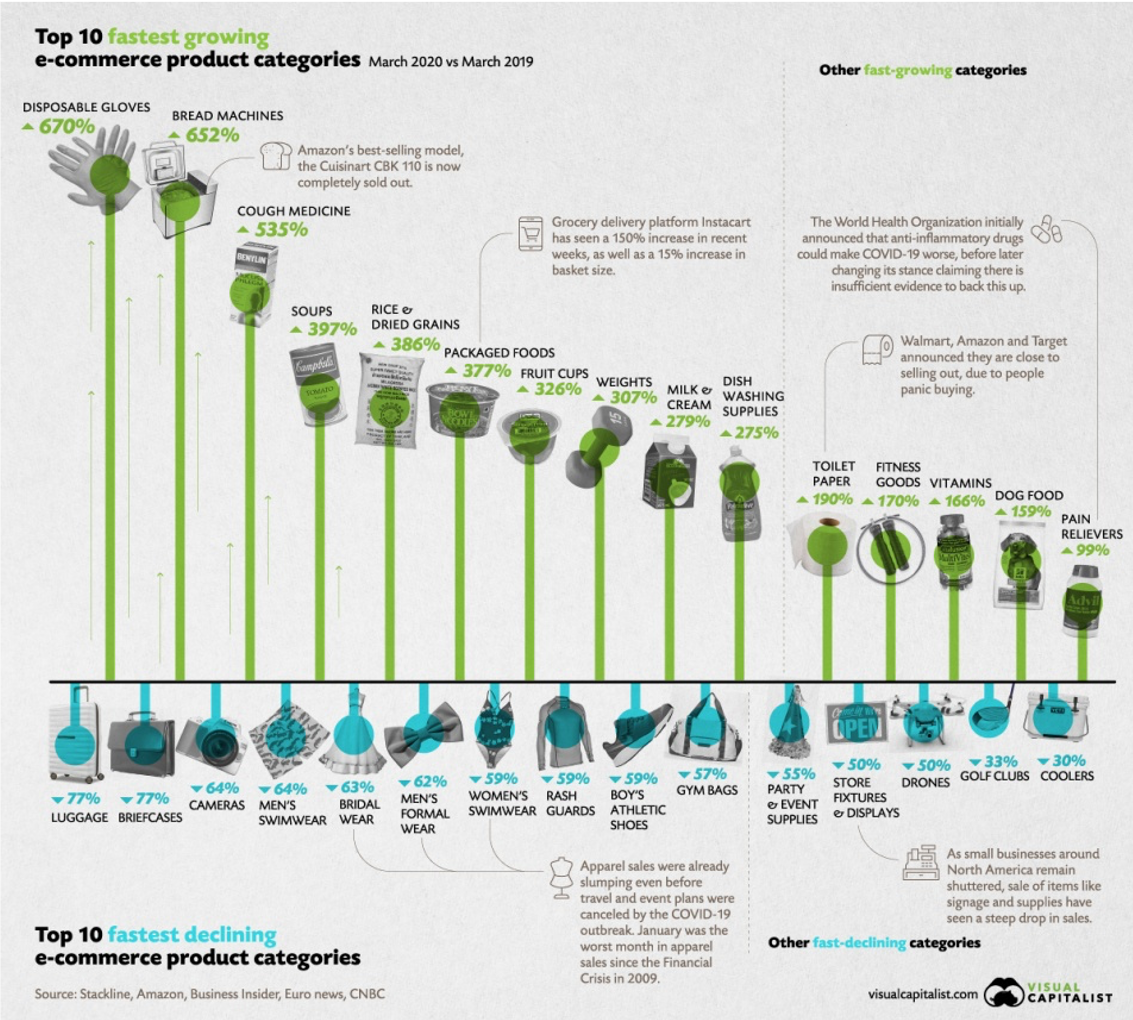

In one of our previous articles, we’ve written about how companies alter their operational needs in accordance with public health officials. Those measures include curbside and contact-less delivery, increased sanitization and use of PPE equipment, and social distancing protocols. Not only are consumer shopping habits are changing for the year 2020, but the implications of COVID 19 can last well into the decade ahead of us. When nonessential businesses were forced to close, and shoppers consequently avoided public spaces, the only other option was to shop online. As if that wasn’t the norm pre-pandemic days already, it sure is now. To feed into the online shopping mentality, people are also panic buying. They’re stockpiling on bulk resources which they find are low on the shelves because scarcity is a scary thing.

Below is data collected by Visual Capitalist that represents the most and least purchased items since the onset of the pandemic.

Top 10 fastest growing e-commerce product categories

The Post Brick-and-Mortar New Reality

Economically speaking, there are winners and losers. Grocery stores and subscription services to various entertainment outlets have seen the most success amid COVID 19. Retail stores, the ones that are originally brick-and-mortar, are not doing so well. In the realm of retail and fashion in particular, there are many novel practices that came into light. Stores are holding the merchandise that customers try on in fitting rooms for a number of days before returning it to the racks in order to ensure safety. Since we know that the virus can last on surfaces up to 3 days, this seems like the logical thing to do. Still though, even after these actions are put into place, 65% of women said they will not feel safe trying on clothes in dressing rooms, and 54% of men will not feel safe using dressing rooms. As a result of this, Omni channel sellers are seeing big losses, in part because they’re closing the retail arms of their businesses altogether. People are understandably not interested in shopping for clothes in person. Department stores like Macy’s and JCPenney, large chains like Abercrombie & Fitch and Nike, and DTC brands with storefronts like Rothys and Everlane are all closing their physical stores and experiencing losses. Others in the likes of Patagonia are even halting their online businesses to protect workers in their supply chain.

Retail store sign

Most places that do welcome back customers for in-store shopping offer hand sanitizing stations, mandatory gloves and masks, plexiglass at check-outs, and even offer to take your temperature prior to entering their premises. You can also be prepared for a screening by way of brief questionnaire to ensure you’ve had no contact with anyone that may have COVID 19. Shoppers also prefer to use self-checkout lanes – a whopping 87% of U.S. shoppers prefer stores with touch-less or robust self-checkout options.

Consumers will likely think twice before splurging on a ‘want’ rather than a ‘need’ item, or perhaps even living slightly more frugally and only purchasing the essentials in order to be equipped for an economic bust (cue bargain hunting and thrifting). Stores that sell jewelry and accessories will especially need to adapt, or they run the risk of their sales slumping. Consumers will likely give preference to brands that offer reassurance and confidence about what they’re doing to handle safety after the pandemic. By the same token, shopping patterns will be globally driven decisions – consumers will be more conscious about where goods are sourced in a post pandemic world, and will be more inclined to choose brands that are transparent about their production and supply chain end.

Our experiences, whether that’s shopping, going for a jog in the park, or grabbing take-out, will all be seemingly different for a long time to come.